Turunc has advised Gelecek Etki Fonu on its investment in Mindsite.

GKC Partners and Gedik & Eraksoy Advise on Ronesans Holding’s Acquisition of Rabobank

White & Case Turkish affiliate law firm GKC Partners has advised Ronesans Holding on its acquisition of Rabobank from Rabobank International Holding. A&O Shearman's Turkish affiliate Gedik & Eraksoy advised Rabobank.

Taylor Wessing Advises VakifBank International on Core Banking System Implementation

Taylor Wessing has advised VakifBank International on the implementation of a core banking system.

Paksoy Advises H.I.G. Capital on Acquisition of Valeo’s Thermal Commercial Vehicles Division

Paksoy, working with Gibson Dunn, has advised H.I.G. Capital on its acquisition of Valeo’s thermal commercial vehicles division.

Turunc Advises Pollet Medical Group on Approval for Acquisition of Farmasol

Turunc has advised Pollet Medical Group on obtaining the approval of the Turkish Competition Board for the majority acquisition of Farmasol.

Turkiye: Recent Developments in Sustainability Reporting under Turkish Law

Due to the importance of disclosure of compliance with sustainability principles in evaluating the performance of companies, to ensure transparency, comparability, and reliability of the disclosures made within the scope of environmental, social, and governance (ESG) considerations, regulations have been introduced in the Turkish legal system.

White & Case, GKC Partners, Baker McKenzie, and Esin Advise on Ulker Biskuvi's USD 550 Million Sustainability-Linked Eurobond Issuance

White & Case and its Turkish affiliate law firm GKC Partners have advised Ulker Biskuvi on its USD 550 million Eurobond issuance. Baker McKenzie and its Turkish affiliate law firm Esin Attorney Partnership advised the bookrunners including J.P. Morgan Securities, Merrill Lynch International, Emirates NBD Bank, HSBC Bank, and Rabo Securities.

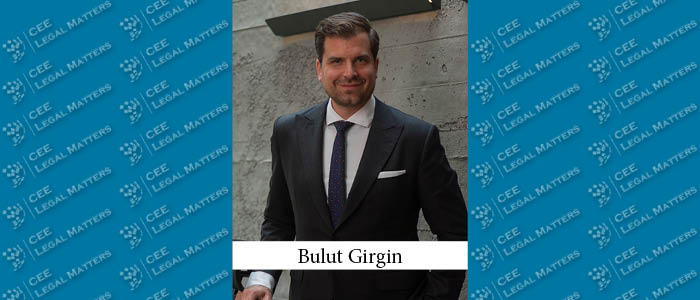

Light at the End of the Tunnel for Turkiye: A Buzz Interview with Bulut Girgin of Gen Temizer

Turkiye’s economy is showing signs of a resurgence, according to Gen Temizer Partner Bulut Girgin who has observed increased optimism among international investors recently, despite high inflation, and who reports a booming IPO market indicating a positive trend that could lead to a major economic boom.

AECO Law Advises Maticmind on Acquisition of Pagetel from General Dynamics

AECO Law, working with Pedersoli Gattai, has advised Maticmind on its acquisition of Pagetel from General Dynamics. Paksoy and Freshfields Bruckhaus Deringer reportedly advised General Dynamics.

Pekin Bayar Mizrahi Advises Idata on Sale to BLS International Services

Norton Rose Fulbright's Turkish affiliate law firm Pekin Bayar Mizrahi has advised Idata on its sale to BLS International Services. Dentons and its Turkish affiliate law firm Balcioglu Selcuk Ardiyok Keki reportedly advised BLS International Services.

Turunc and Keco Advise on Bogazici Ventures' Follow-on Investment in Hiwell

Turunc has advised Bogazici Ventures on its follow-on investment in Hiwell in a round that also saw Eksim Ventures, Unlu & Co, and Kinesis Teknoloji Yatirimlari join. Keco advised Hiwell. Gunduz & Gunduz reportedly advised Kinesis.

Kinstellar and KST Law Advise Grupo Antolin on Sale of Stake in Ototrim to Diniz Holding

Kinstellar and its Turkish affiliate KST Law have advised Grupo Antolin on the sale of a 45% stake in the Turkish joint venture Ototrim to its JV partner Diniz Holding. SEOR Law reportedly advised Diniz Holding.

Ozge Ayoz Becomes VP of Legal at Procter & Gamble

Turkish Lawyer Ozge Ayoz has been appointed to Vice President of Legal for Central Europe, South East Europe and Eastern Europe Market Operations at Procter & Gamble in Geneva.

Turunc Advises ComposeVC on Inaugural Fund Formation

Turunc has advised ComposeVC on the formation of its inaugural venture capital fund, ComposeVC Built-World Fund.

CMS Advises Entek on Acquisition of Solar Power Projects from Ecoenergy

CMS has advised Entek Elektrik Uretim on the acquisition of two Romanian companies owning the rights to a 214.26-megawatt solar power project under development from UK-based Econergy International.

Baker McKenzie, Esin, A&O Shearman, and Gedik & Eraksoy Advise on Akbank's USD 500 Million Sustainability Notes Issuance

Baker McKenzie and its Turkish affiliate Esin Attorney Partnership have advised Akbank on the issuance of USD 500 million senior unsecured sustainability notes due in 2030. A&O Shearman and its Turkish affiliate Gedik & Eraksoy advised the joint bookrunners.

Paksoy Advises BlaBlaCar on Acquisition of Obilet

Paksoy has advised BlaBlaCar on its acquisition of Obilet.

Aksan Advises on Horoz Logistics IPO

Aksan has advised Horoz Logistics on its IPO.