NKO Partners has advised CTP on the acquisition of land in Kragujevac, Serbia, from Stellantis’ subsidiary Fiat Srbija. Karanovic & Partners advised Fiat Srbija.

EU Artificial Intelligence Act and Its Impact on Non-EU Entities

Last year, a new regulation on artificial intelligence (“AI Act”) was published in the Official Journal of the European Union. This new AI Act lays down legal framework for the development, placing on the market, putting into service and use of artificial intelligence systems (“AI systems”) in the EU, in order to, inter alia, promote the uptake of human centric and trustworthy artificial intelligence, protect against harmful effects of AI systems and to support innovation.

(Re)Shaping Belgrade

Belgrade’s history is a testament to its resilience and adaptability. Over centuries, the city has been a crossroads of civilizations, with each era bringing new rulers, new ideas, and new architectural styles.

Impact of OFAC Sanctions on NIS AD Novi Sad and Options for their Removal

On 10 January 2025, the Office of Foreign Assets Control (“OFAC”) of the U.S. Department of Treasury’s issued a Determination pursuant to Section 1(a)(i) of Executive Order 14024 (“the EO 14024 Determination”) and a Determination pursuant to Section 1(a)(ii) of Executive Order 14071 (“the EO 14071 Determination”).

ZSP Advises NLB Komercijalna Banka on EUR 45.5 Million Facility for Crowne Plaza Belgrade Refinancing

ZSP has advised NLB Komercijalna Banka on a EUR 45.5 million facility for Delta Real Estate for the refinancing of Crowne Plaza Belgrade.

Serbian Competition Commission Submits Four Draft Proposals to Government for Block Exemption Regulations

On 21 January 2025, the Serbian Commission for Protection of Competition submitted draft proposals to the Government for four new regulations concerning the exemption of certain categories of agreements from the prohibition of restrictive agreements.

Well-Known Trademarks: Legal Standards and Determination Criteria

Trademarks are more than just logos and brand names—they are powerful symbols that represent the values, quality, and recognition of a company or product. From the iconic swoosh of Nike to the golden arches of McDonald's, well-known trademarks have become ingrained in our daily lives, shaping our consumer habits and perceptions.

The Debrief: January, 2025

In The Debrief, our Practice Leaders across CEE share updates on recent and upcoming legislation, consider the impact of recent court decisions, showcase landmark projects, and keep our readers apprised of the latest developments impacting their respective practice areas.

The Debrief: April, 2025

In The Debrief, our Practice Leaders across CEE share updates on recent and upcoming legislation, consider the impact of recent court decisions, showcase landmark projects, and keep our readers apprised of the latest developments impacting their respective practice areas.

The Corner Office: New Practice Development Strategy

In The Corner Office, we ask Managing Partners at law firms across Central and Eastern Europe about their backgrounds, strategies, and responsibilities. This time around we turn our attention to setting up new practices and ask: When launching a new practice, what is your go-to strategy – do you look at internal team members to spearhead it, or are you more likely to turn to lateral hires? Why?

La Grande Nouvelle Du Jour: Serbia and France Sign Transformative Agreements

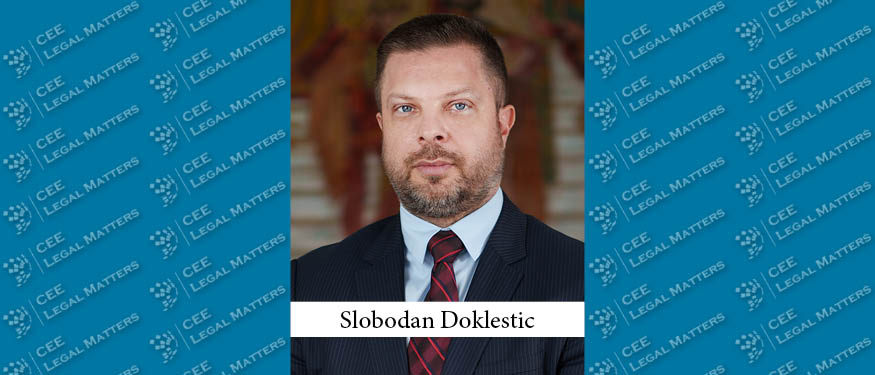

Serbia and France recently deepened their bilateral relations by signing multiple strategic agreements during French President Emmanuel Macron’s visit to Belgrade. These agreements span multiple sectors and are poised to have profound impacts on Serbia’s economy, business environment, and legislative landscape. Doklestic Repic & Gajin Partner Slobodan Doklestic and NKO Partners Partner Petar Orlic look at these agreements and their anticipated effects.

Know Your Lawyer: Slobodan Doklestic of Doklestic Repic & Gajin

An in-depth look at Slobodan Doklestic of Doklestic Repic & Gajin covering his career path, education, and top projects as a lawyer as well as a few insights about him as a manager at work and as a person outside the office.

Digital Nomads in Croatia, Montenegro, and Serbia

Central and Eastern Europe is increasingly on the radar of digital nomads seeking new destinations. The countries they flock to see their markets impacted – for better or worse – with both opportunities and challenges aplenty. Babic & Partners Partner Marija Gregoric and JPM & Partners Partner Jelena Nikolic analyze these impacts.

Serbia: Non-Compete Clauses Labor Law

Non-competition (non-compete) clauses came into the spotlight this year as the US Federal Trade Commission (FTC) decided to impose a broad ban on their use. The underlying motive for this is the perception that the non-compete clauses, in the words of FTC Chair Lina Khan, keep wages low, suppress new ideas, and rob the American economy of dynamism, including from the more than 8,500 new start-ups that would be created a year once non-competes are banned. However, this rule quickly faced challenges, including a lawsuit from the US Chamber of Commerce, which argued that it was unfounded and that the FTC exceeded its authority.

Unauthorized Monitoring of Employees’ Email – A Case from Italian Practice

This article analyzes the Decision of the Italian Data Protection Commissioner (“Commissioner“) No. 472 of July 17, 2024 (“Decision“), which concerns the monitoring of employees’ official computers and emails, and the protection of personal data in accordance with Italian regulations and the General Data Protection Regulation of the European Union, which was adopted on April 14, 2016, and came into force on May 25, 2018 (“GDPR”).

Schoenherr Advises RP Global on Sale of Renewable Energy Portfolio to Alcazar Energy Partners

Moravcevic, Vojnovic and Partners in cooperation with Schoenherr has advised RP Global on the sale of 100 % of the share capital in a portfolio comprising a 200-megawatt onshore wind power project located east of Belgrade and a 768-megawatt pipeline of wind and solar projects in Serbia to Alcazar Energy Partners.

DPO and Representative – Personal Data Protection

Although more than six years have passed since the adoption of the new Personal Data Protection Law (the “Law“), there are still practical uncertainties about when data controllers and processors must appoint a Data Protection Officer (DPO). Additionally, many foreign data controllers and processors subject to the Law have yet to fulfill their obligation to appoint a representative for personal data protection. This lack of compliance makes it harder for individuals to exercise their rights when it comes to the processing of their personal data.

Corporate Due Diligence Obligations in Supply Chains in Germany and the Impact of the Serbian Economy

The German Law on the Corporate Due Diligence Obligations for the Prevent of Human Rights Violations in Supply Chains introduces for the first time the obligation for German companies to comply with certain procedures and rules, implement due diligence obligations and appropriate measures, in supply chains, with the aim of preventing human rights violations and damages to the environment. The mentioned German Law does not have a direct impact on companies in Serbia, so the sanctions prescribed by that Law cannot be enforced in Serbia, however, there is a certain influence on Serbian companies that will need to comply with, for reasons of further cooperation with German companies.