Kyriakides Georgopoulos has advised Sitecore on the sale of its Moosend business, including both company shares and related assets, to Constant Contact. Bernitsas advised Constant Contact.

Zepos & Yannopoulos Advises Tao Digital Solutions on Acquisition of Software Competitiveness International

Zepos & Yannopoulos, working with LLA Logos Legal Advisor, has advised Tao Digital Solutions on its acquisition of Software Competitiveness International.

Lambadarios Advises Halcyon Equity Partners on Investment in AlfaOmega Pharma Logistics

Lambadarios has advised Halcyon Equity Partners on its investment in AlfaOmega Pharma Logistics. Solo practitioner Kalliopi Sereli reportedly advised AlfaOmega Pharma Logistics.

Lambadarios and Sioufas and Associates Advise on Halcyon Equity Partners' Investment in Evoiki Zimi

Lambadarios has advised Halcyon Equity Partners AIFM on its investment in Evoiki Zimi. Sioufas and Associates advised Evoiki Zimi.

Lambadarios Advises International Schools Partnership on Acquisition of Ellinogermaniki Agogi

Lambadarios has advised the International Schools Partnership on its acquisition of Ellinogermaniki Agogi.

Kyriakides Georgopoulos Advises Sirec Energy on EUR 600 Million CCGT Power Plant Project in Greece

Kyriakides Georgopoulos has advised Sirec Energy on its joint participation in Larissa Thermoelectric alongside Clavenia, DEPA Commercial, and Volton.

Lambadarios and Marinos Petroulias Advise on EUR 1.3 Billion Financing for Crete’s Northern Road Axis

Lambadarios has advised the four systemic Greek banks Alpha Bank, Eurobank, Piraeus Bank, and the National Bank of Greece on the EUR 1.3 billion financing of the new Northern Road Axis of Crete. Marinos Petroulias advised the developer, GEK Terna.

Greece’s Real Estate: A Market with a View

After a decade of economic challenges, Greece’s real estate market is thriving, fueled by a tourism boom and strong foreign investment. With property prices still below pre-crisis levels and a growing focus on sustainability, PPT Legal Partner Alexandra Mitsokali and Moussas & Partners Senior Partner Loukia Papachatzi explore the sector’s revival.

Greece’s Golden Visa: A Decade of Evolution

Since its initial launch in 2013, Greece’s Golden Visa program has proven to be one of Europe’s most enduring residency-by-investment initiatives. Over the years, it has continuously adapted to shifting economic conditions, investment landscapes, and EU-level scrutiny. Drakopoulos Senior Associate and Head of Immigration Angie Alevizou takes a closer look at its evolution, outcomes, potential future changes, legal challenges, and competitiveness going forward.

Inside Insight: Konstantinos Argyropoulos of Space Hellas

With nearly three decades of experience in the legal and technology sectors, Space Hellas General Counsel Konstantinos Argyropoulos reflects on his journey as an international lawyer, from studying law in Athens, Paris II, and Harvard to leading the legal team of a multinational tech company.

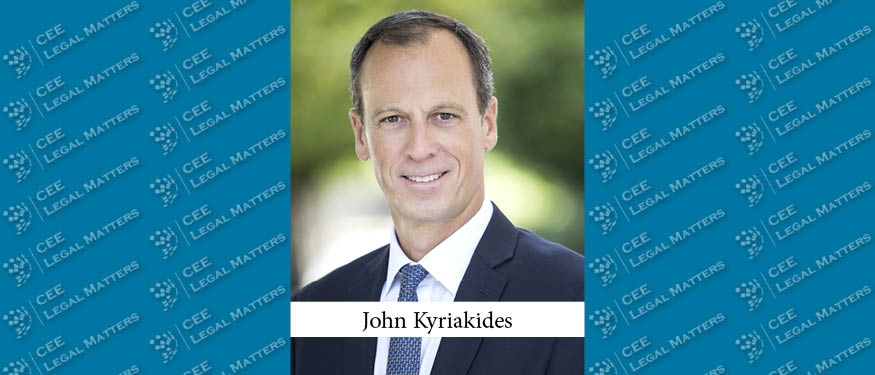

Know Your Lawyer: John Kyriakides of Kyriakides Georgopoulos

An in-depth look at John Kyriakides of Kyriakides Georgopoulos covering his career path, education, and top projects as a lawyer as well as a few insights about him as a manager at work and as a person outside the office.

Greece: Key Differences and Selection Criteria in Concession Agreements vs Public-Private Partnerships

Governments increasingly involve the private sector in infrastructure projects through concession agreements or public-private partnerships (PPPs). While both models attract private investment, they differ significantly in financial structures, risk allocation, and regulatory framework. Choosing the appropriate model depends on project objectives, revenue generation potential, and public sector involvement in funding and oversight.

Zepos & Yannopoulos Advises Kersia Group on Acquisition of Majority Stake in Ikochimiki

Zepos & Yannopoulos has advised France-based Kersia Group on its acquisition of a majority stake in Greece-based Ikochimiki.

Lambadarios Advises European Dynamics on Investment from CAPZA and Abry Partners

Lambadarios, working with Ashurst, has advised European Dynamics on an investment from CAPZA, through its Flex Equity Mid-Market 2 fund, and Abry Partners. Paul Hastings reportedly advised CAPZA. Kirkland & Ellis reportedly advised Abry Partners.

AKL Advises Alpha Bank on Financing of Stoa Arsakeio Revitalization Project

AKL Law Firm has advised Alpha Bank on the financing for Legendary Food for the Stoa Arsakeio redevelopment project in central Athens. KBVL reportedly advised Legendary Food.

Booming Greece: A Buzz Interview with Panagiotis Sardelas of Sardelas Petsa

Greece is booming in 2025, with robust investments across construction, hospitality, and energy sectors, according to Sardelas Petsa Managing Partner Panagiotis Sardelas, who stresses that digital infrastructure and capital markets are also gaining momentum.

Koutalidis Advises Alpha Bank on Establishment of New Green Bond Framework

Koutalidis has advised Alpha Bank on the creation of its new Green Bond Framework.

Zepos & Yannopoulos Advises Bracebridge Capital on Frontier III NPL Securitisation

Zepos & Yannopoulos has advised the entities managed by Bracebridge Capital on the securitization of the Frontier III portfolio, a EUR 700 million non-performing loan portfolio originated by the National Bank of Greece.