An overview of important legislative changes in the Czech Republic

Another summer of grace

The government of the Czech Republic is preparing another so-called summer of grace from 1 July to 30 November 2023. It will be possible to apply for remission of accessories (penalties, interest, fines) of tax and social security payments, if the outstanding payment is paid, and for remission of minor arrears.

Increase in point value for work accidents

With effect from 1 January 2023, the government decided on a fundamental increase in the value of a point within the point evaluation of compensation for pain and social impairment in the event of work accidents or occupational diseases. Newly, the value of the point is variable and determined as 1% of the average wage in the national economy determined for the first to third quarter of the calendar year of the previous year. For 2023, this means an increase in the point value from CZK 250 to CZK 393.06.

The new decision-making practice on the moderation of contractual penalties

The Supreme Court deviated from the previous decision-making practice on the moderation of contractual penalties within the meaning of Section 2051 of the Civil Code. Newly, the unreasonableness of the contractual penalty agreement is not examined, but the unreasonableness of a specific right to a contractual penalty. To determine whether a claim is unreasonable, it is necessary to examine how and under what circumstances the breach of the contractual obligation establishing the right to the contractual penalty occurred and to what extent it affected the creditor's interests protected by the penalty. The procedure for moderating the penalty is therefore such that the court first determines what function the contractual penalty was meant to fulfil. It then deals with specific circumstances at the time the contractual penalty was negotiated and at the time the contractual obligation was breached. If it finds that the penalty is inadequate given the circumstances examined, it can reduce it to a reasonable amount.

Discount on social security for employers

From 1 February 2023, employers can apply a 5% discount on social security premiums for certain groups of employees (e.g. people over 55 years of age, people caring for a child under 10 years of age, students, people with health disabilities or people under 21 years of age). The condition of the discount is, among other things, a work or service relationship with a shorter working time of 8 to 30 hours per week (for persons under the age of 21 years of age, it can even be applied for any working time) and timely application of the discount. The discount can also be applied only if the employee's income does not exceed 1.5 times the average salary (currently CZK 60,486). Some other restrictions also apply.

Adequate minimum wage in individual EU countries

A new EU directive has been issued that sets out procedures to ensure an adequate level of minimum wages in individual EU states and to support collective bargaining on wage setting. The directive should be incorporated into Czech law by 15 November 2024.

Notification obligation of the assignor towards the debtor

Even though Section 1882(1) of the Civil Code does not contain an explicit order for the assignor to notify the assignment of a claim to the debtor, according to the Supreme Court, this obligation follows from the principle of protection of the debtor, whose consent to the assignment is not required (File 20 Cdo 1911/2022).

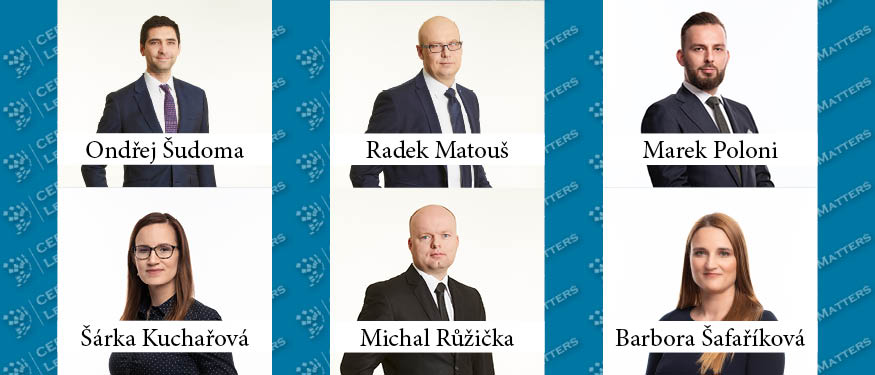

By Radek Matous, Partner, Barbora Safarikova, Senior Associate, Michal Ruzicka, Senior Associate, Sarka Kucharova, Associate, Marek Poloni, Associate, Ondrej Sudoma, Associate, Eversheds Sutherland