Clifford Chance has advised Sumitomo Mitsui Banking Corporation as the sole coordinator, sole bookrunner, and mandated lead arranger on a JPY 80 billion samurai loan for Energeticky a Prumyslovy Holding.

Savoric & Partners Advises Ing-Grad on IPO to Raise EUR 55 Million

Savoric & Partners has advised Ing-Grad on its planned IPO on the Zagreb Stock Exchange, where the company aims to raise approximately EUR 55 million by selling 30% of its treasury shares.

Bernitsas Advises Eurobank Holdings on EUR 588.5 Million Liability Management Exercise

Bernitsas has advised Eurobank Ergasias Services and Holdings on a liability management exercise totaling EUR 588.55 million.

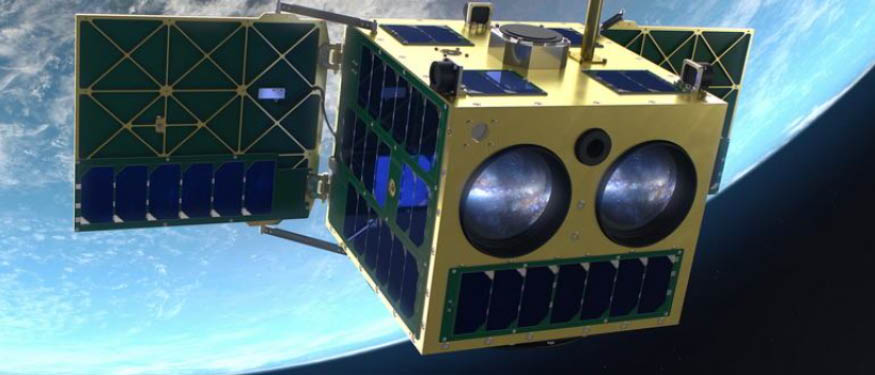

Gessel Advises Creotech Instruments Public Offering of New Shares

Gessel has advised Creotech Instruments on the public offering of its newly issued shares.

White & Case and Rymarz Zdort Maruta Advise on Polish State Treasury's USD 5.5 Billion Dual-Tranche Note Issuance

White & Case has advised the State Treasury of the Republic of Poland on the issuance of a USD 5.5 billion dual-tranche of SEC-registered bonds. Rymarz Zdort Maruta, working with Latham & Watkins, advised the banks involved.

A&O Shearman and Clifford Chance Advise on Doosan Skoda Power's Prague Stock Exchange IPO

Allen Overy Shearman Sterling has advised Doosan Skoda Power on its CZK 2.53 billion initial public offering on the Prime Market of the Prague Stock Exchange. Clifford Chance advised the joint global coordinators Raiffeisen Bank and Wood & Company.

Akol Advises on Visne Madencilik's IPO

Akol has advised Visne Madencilik on its initial public offering and listing on Borsa Istanbul.