European Commercial Courts are positioning themselves as alternatives to other national courts as they remain closely tied to domestic court systems.

Taylor Wessing Announces Alliance with Orsingher Ortu – Avvocati Associati

Taylor Wessing has announced an alliance with the Italian law firm Orsingher Ortu – Avvocati Associati.

The Corner Office: 2024 in (Volume) Review

In The Corner Office, we ask Managing Partners at law firms across Central and Eastern Europe about their backgrounds, strategies, and responsibilities. With 2024 behind us, we asked: Looking at transactional volumes for this year, would you say that 2024 was better or worse than what you originally expected it to be, and why?

Austria: Digital Operational Resilience Act (DORA) – Opportunities and Challenges

The Digital Operational Resilience Act (DORA) is a central component of the EU’s Digital Finance Package. The aim is to enhance information and communications technology (ICT) security and digital operational resilience in the financial sector. Financial institutions and ICT service providers have until January 17, 2025, to fully implement the requirements.

Brandl Talos and Herbst Kinsky Advise on Xund's EUR 6 Million Pre-Series A Financing Round

Brandl Talos has advised Xund on a EUR 6 million pre-series A financing round led by Lead Ventures with participation from J&T Ventures and existing investors MassMutual Ventures, TBA network, and Lana Ventures. Herbst Kinsky, and reportedly Erdos Partners, advised Lead Ventures.

Freshfields Advises Shareholders on Sale of Leiber to Asahi Group Foods

Freshfields has advised the shareholders of Leiber on the full sale of the company to Asahi Group Foods, a subsidiary of Asahi Group Holdings.

DLA Piper Advises Marinomed on Sale of Carragelose Business to Unither Pharmaceuticals

DLA Piper has advised Marinomed Biotech on the sale of its Carragelose business to Unither Pharmaceuticals. Lamartine Conseil reportedly advised Unither Pharmaceuticals.

The Art of the Rare Earth Deal: Is the Devil in the Details?

Mineral rights deals may seem like a big win, but they are not without risk. Considering the wider implications of mineral rights deals.

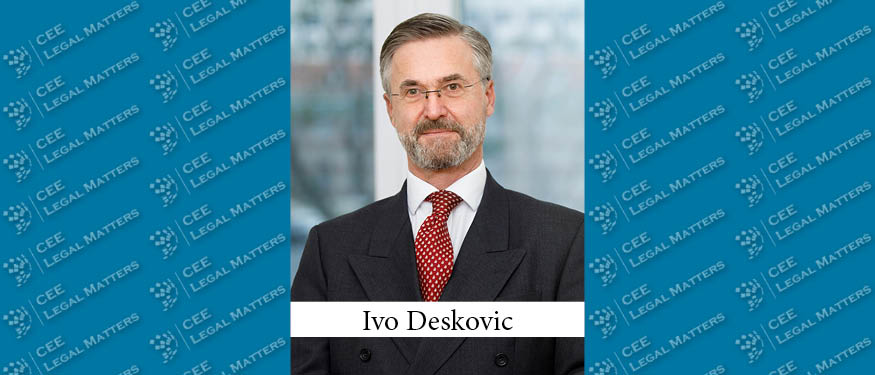

What is Green in Austria? A Buzz Interview with Ivo Deskovic of Taylor Wessing

Sustainability-related disputes, cyber security issues, and corporate restructurings are shaping Austria’s legal dispute landscape, with courts and arbitration increasingly tackling ESG issues and greenwashing claims, according to Taylor Wessing Partner Ivo Deskovic who highlights a surge in insolvencies as well as the long-anticipated implementation of the EU Class Action Directive.

Dorda, Freshfields, and E+H Advise on Sprints's Partnership with Styria Media Group for Acquisition of Adevinta’s Shares in Willhaben

Dorda, working with Roschier, has advised European growth investor Sprints on its partnership with Styria Media Group to acquire all of Adevinta’s shares in Willhaben. Freshfields advised Adevinta. E+H advised Styria Media Group.

E+H and Wolf Theiss Advise on Megatech's Restructuring and Sale to Sapa

E+H has advised Megatech Industries on its reorganization from financial distress and subsequent sale to Italian mobility supplier Sapa. Wolf Theiss, working with Gianni & Origoni, advised Sapa.

Cerha Hempel Advises OMV on Partnership with ADNOC

Cerha Hempel has advised OMV on a partnership with Abu Dhabi National Oil Company to create Borouge Group International.

Baker McKenzie and Binder Groesswang Advise on Burgenland Energie's EUR 1.3 Billion Renewable Energy Financing

Baker McKenzie has advised Burgenland Energie Group on structuring and implementing a EUR 1.3 billion portfolio project financing for renewable energy expansion. Binder Groesswang, working with Hogan Lovells, advised the banks.

Shaping the Future of Energy: Legal Implications of Austria's New Government Programme

The government programme of the three-party coalition for the years 2025-2029 has been established. In the field of energy law, long-awaited legislation such as the Electricity Industry Act (ElWG), the Renewable Gas Act (EGG) and the Renewable Expansion Acceleration Act (EABG) are set to be enacted.

EU's Clean Industrial Deal: Merging Climate Goals with Competitiveness

On 26 February 2025, the European Commission (EC) unveiled the Clean Industrial Deal (CID), a comprehensive strategy aimed at enhancing the competitiveness and resilience of European industry while accelerating decarbonisation. In response to high energy costs and increasing global competition, the CID positions decarbonisation as a key driver of growth, ensuring that Europe remains a hub for industrial innovation and production. By reducing bureaucratic hurdles, promoting clean technology and securing financing for the green transition, the initiative strengthens critical sectors such as energy-intensive industries and clean tech.

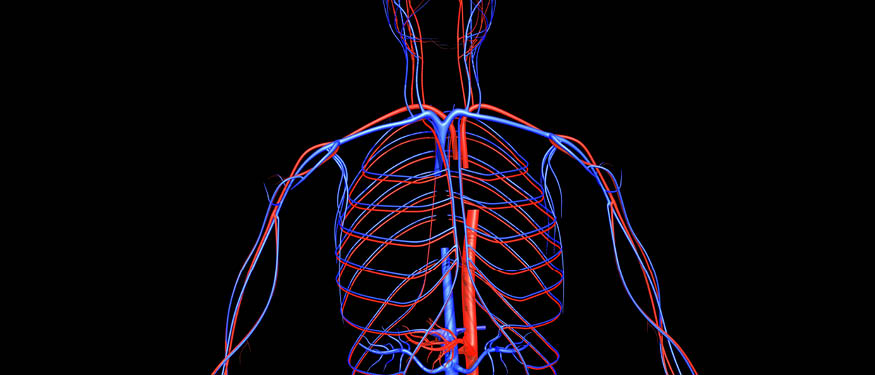

Freshfields Advises Biotronik on Sale of VI Business to Teleflex

Freshfields has advised Biotronik Group on an agreement to divest its Vascular Intervention division to Teleflex Incorporated.

Harald Strahberger Joins Kinstellar as Partner in Vienna

Harald Strahberger has joined Kinstellar as Partner in Vienna.

E+H Advises Podero on EUR 5.5 Million Seed Financing Round

E+H has advised Podero on its EUR 5.5 million seed financing round led by German GreenTech fund Planet A Ventures, with co-investment from Systemiq Capital, and participation from Swedish VC Pale Blue Dot and Austrian VC PUSH Ventures. Dorda reportedly advised Planet A Ventures.