On 26 February 2025, the European Commission (EC) unveiled the Clean Industrial Deal (CID), a comprehensive strategy aimed at enhancing the competitiveness and resilience of European industry while accelerating decarbonisation. In response to high energy costs and increasing global competition, the CID positions decarbonisation as a key driver of growth, ensuring that Europe remains a hub for industrial innovation and production. By reducing bureaucratic hurdles, promoting clean technology and securing financing for the green transition, the initiative strengthens critical sectors such as energy-intensive industries and clean tech.

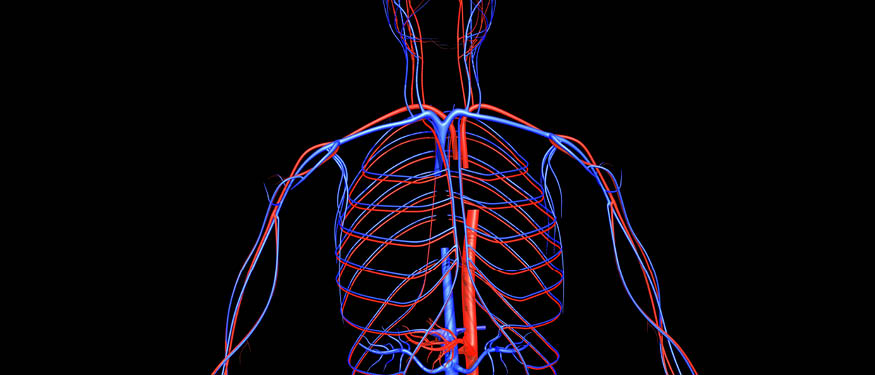

Freshfields Advises Biotronik on Sale of VI Business to Teleflex

Freshfields has advised Biotronik Group on an agreement to divest its Vascular Intervention division to Teleflex Incorporated.

Harald Strahberger Joins Kinstellar as Partner in Vienna

Harald Strahberger has joined Kinstellar as Partner in Vienna.

E+H Advises Podero on EUR 5.5 Million Seed Financing Round

E+H has advised Podero on its EUR 5.5 million seed financing round led by German GreenTech fund Planet A Ventures, with co-investment from Systemiq Capital, and participation from Swedish VC Pale Blue Dot and Austrian VC PUSH Ventures. Dorda reportedly advised Planet A Ventures.

Freshfields, BDK Advokati, and Baker McKenzie Advise on Midea's Acquisition of Arbonia Climate Division

Freshfields has advised Midea Group subsidiary Midea Electrics Netherlands on its EUR 750 million acquisition of the climate division from Arbonia AG. BDK Advokati advised Midea on the local aspects of the acquisition of Serbian company Termovent, as part of the broader transaction. Baker McKenzie advised Arbonia.

FWP Advises Pierer Industrie Creditors on Restructuring Plan Acceptance

Fellner Wratzfeld & Partner has advised approximately 38% of the creditors in the restructuring proceedings of Pierer Industrie on a vote under the Restructuring Ordinance in Austria.

Austria: Data Strategy – Data Act and Data Governance Act in Focus

Austria’s data strategy is derived from the European data strategy. It aims to improve the framework conditions for the data economy and to promote the secure exchange and broad use of data.

GDPR Fines and Data Breach Trends in the CEE Region

The latest DLA Piper GDPR Fines and Data Breach Survey provides a comprehensive overview of data protection enforcement trends across Europe, including the Central and Eastern European (CEE) region. CEE countries are in the mid-range in terms of total GDPR fines imposed since the regulation became applicable in 2018 and for last year, but enforcement activity is steadily increasing. Here are the latest trends and legal developments in Austria, the Czech Republic, Hungary, Poland, Romania, and Slovakia.

Austria: Federal Fiscal Court Rules That Voluntary Self-Disclosure of Missed UBO filings does not require immediate UBO Filing To Qualify for Exemption from Late Filing Penalties

The Austrian Beneficial Owners Register Act (BORA) requires certain legal entities to report their ultimate beneficial owners (UBO) recurringly, at least once a year and whenever changes occur in an entity's UBO.

Baker McKenzie Advises Dertour Group on Acquisition of Hotelplan Group

Baker McKenzie has advised Dertour Group on its acquisition of the Hotelplan Group, with the exception of Interhome, which is being acquired by the HomeToGo Group. Bar & Karrer reportedly advised the seller – Migros.

Kinstellar, Binder Groesswang, and FWP Advise on Limestone Capital's Investment in Loisium Wine & SPA Hotels

Kinstellar and Binder Groesswang, working with Jeantet, have advised LC Hospitality Holding on the acquisition of a 60% majority stake in Loisium Wine & SPA Holding via a share deal. FWP advised the seller – Soravia Group.

Cerha Hempel and DGKV Advise on Semantic Web Company's Partnership with Ontotext to Form Graphwise

Cerha Hempel has advised the shareholders of Semantic Web Company and the company itself on a collaboration with Ontotext which resulted in the formation of Graphwise. Djingov, Gouginski, Kyutchukov & Velichkov advised Ontotext.

BPV Huegel and Binder Groesswang Advise on Eavista's Acquisition of 75.1% of Card Complete Service Bank

BPV Huegel has advised Eavista on the acquisition of 75.1% of the shares in Card Complete Service Bank from UniCredit Bank Austria and Raiffeisen-Invest-Gesellschaft. Binder Groesswang advised Raiffeisen Bank. Dorda reportedly advised UniCredit Bank Austria.

CMS Advises Laerdal Medical on Acquisition of SIMCharacters

CMS has advised Laerdal Medical on its acquisition of SIMCharacters. Frotz Riedl reportedly advised the sellers.

Thomas Hartl and Christoph Schober Make Partner at Binder Groesswang

Thomas Hartl and Christoph Schober have been promoted to Partner at Binder Groesswang.

Austria: EU Gas-Hydrogen Package: On the Party Status in the Procedure for the Decommissioning of Natural Gas Distribution Networks under the Internal Gas Market Directive

As part of the EU Gas and Hydrogen Package, Directive (EU) 2024/1788 of 13 June 2024 ("Internal Gas Market Directive; IGMD") makes provisions for the first time on the phase-out of gas by network operators through the decommissioning of gas networks. Article 57 IGMD stipulates that gas distribution system operators ("DSO") must develop network decommissioning plans ("NDP") if a reduction in natural gas demand is foreseeable. The competent national authorities assess whether the NDP for the distribution network meets the principles set out in the IGMD.

FWP Advises Varta on StaRUG Restructuring

Fellner Wratzfeld & Partner has advised German battery manufacturer Varta in StaRUG restructuring proceedings.

Herbst Kinsky and Cerha Hempel Advise on Mavoco's EUR 11 Million Series A+ Financing Round

Herbst Kinsky has advised Mavoco on its EUR 11 million series A+ financing round led by 3TS Capital Partners, red-stars.com, and additional investors. Cerha Hempel advised red-stars.com. Dorda reportedly advised 3TS.