Energy prices have been a salient issue in CEE for the past year. Part 1 of this article covered just how high the energy prices had climbed in Bulgaria, the Czech Republic, Moldova, Montenegro, Poland, and Turkey, the impact of those prices on people, businesses, and governments, as well as the reasons why some countries fared better than others. Then Russia’s war against Ukraine changed everything, making a new energy pricing normal seem more distant than ever. In Part 2 we look at what energy experts believe could alleviate the situation and whether the war has impacted those plans.

Short-Term Measures

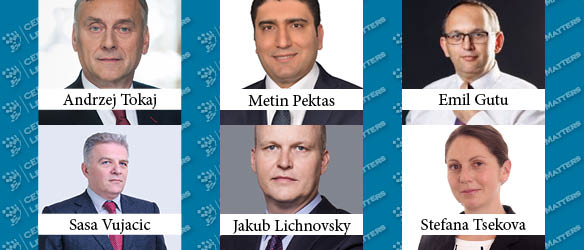

“Even before the war, Moldova was under severe pressure trying to mitigate a fourfold increase of the gas price by its eastern supplier. Yet the raft of problems facing Moldova is currently being addressed, according to ACI Partners Competition Manager Emil Gutu. The government has declared a state of emergency in the country specifically to tackle the energy issue, he says. “That gave the government the possibility to unlock the strategic heating oil reserves; bypass the regular natural gas acquisition provisions when the traditional gas supplier reduced supply, so Moldova was able to import natural gas acquired on the EU spot market for the first time; streamline the allocation of money to both energy market operators and consumers; and retroactively increase regulated gas prices, to prevent the universal service gas company from going bankrupt.” Gutu reports that “financial support – amounting to more than 1% of Moldova’s GDP – was issued to alleviate the natural gas and gas-based central heating price shocks for the population, with liquidity support also provided to the country’s universal service gas supplier.”

For PRK Partners Partner Jakub Lichnovsky the first step towards stabilizing energy prices would be for businesses to “execute agreements directly with energy producers in order to maintain supply levels.” Short term, he believes an energy price war between countries is possible, so prudent steps should be taken. “Poland has waived or significantly lowered VAT on gas, food, and petrol, to soften the inflation blow, and other countries will follow,” he notes. And avoiding the speculative price increase of emission allowances would also go a long way. “This is not only a matter of legal work, I’m afraid, politicians would have to pitch in,” he adds.

Penteris Senior Partner Andrzej Tokaj confirms that, as election season is nearing in Poland, the “government is taking appropriate measures to prepare for these elections by decreasing taxes. They have, for instance, decreased VAT, while excise tax has been abolished. These measures are temporary – intended for the first five months of the year.” Meanwhile, he says the focus in Poland has shifted dramatically as a result of the Russian invasion of Ukraine. “Prices of oil and gas have soared counteracting any positive effects of the tax relief.”

In Bulgaria, on the other hand, Schoenherr Partner Stefana Tsekova says that “after the moratorium on regulated prices expires, it’s clear the regulator would opt for increasing prices. While the government would like to keep prices low, they probably won’t be able to, even in the short term.” And increased electricity prices will lead to higher inflation, she says, with “most prices having already increased. It’s not just electricity. It’s also the case of raw materials and components, including those specifically used in the construction of solar panels and wind turbines.” As a result, Tsekova reports, “if those prices continue to rise, some experts say it could make economic sense (if little else) to continue the operation of the coal-fired power stations, even when considering the related emission fines.”

Speaking of regulated prices, Nazali Partner Metin Pektas points out that energy prices could be considered a part of social policy in Turkey, “so no government would take it upon itself to remove the subsidies. They are also part of our broader economic development policy, so they will definitely stay in place.” In fact, he says that “the government is fast at work on a new social subsidy program on energy. To be a successful public policy it should aim for helping the most vulnerable parts of society and encompass more narrowly targeted subsidies for those people who can’t afford to do anything about their energy consumption.” To that end, Pektas reports that “last month the government changed the tariffs methodology to reduce electricity prices for low-consumption consumers.”

Finally, a net electricity exporter with regulated electricity prices locked in since 2019, Montenegro seems to be in a good place regarding its energy mix as well, according to Vujacic Law Office Partner Sasa Vujacic. “Overall, about 40% of the electricity generated in Montenegro comes from thermal power plants, with most of the rest being hydropower. And there are operational renewable projects as well, like the Krnovo wind station, a 72-megawatt project that was 70% financed by the EBRD,” he reports.

Connecting the Infrastructure Dots

Despite circumstances and short-term needs and reactions being different in each country, everyone agrees on one thing: the importance of improving, diversifying, and interconnecting energy infrastructure.

Moldova, for one, is speeding up its interconnection with the European energy market, Gutu reports: “the country is already connected to the Romanian (and European) gas network via the Trans-Balkan pipeline and the brand-new Iasi-Chisinau pipeline, while the contract for the development of a new high-voltage power line allowing for a better connection between Moldova’s and Romania’s power grids has finally been signed.”

Tokaj says the focus in Poland is now on energy security rather than on energy prices. “The country seems to be quite well-prepared to shift from Russian imports to alternative sources.” He reports that “the Baltic pipeline is expected to be up and running later this year, which will secure the deliveries of gas from Norway, and the Swinoujscie port is working at full capacity in receiving LPG from the Gulf.”

Lichnovsky agrees on both counts, going even further: “the EU needs to diversify its sources of gas by increasing supply from Algeria and Norway and expand capacities and infrastructure for LNG supply mainly from the US, Qatar, and Australia.” He emphasizes that “it must be understood that it is the discretion of gas suppliers whether to deliver gas on the spot market. So, we need to lock-in long-term contracts and focus on diversification of sources to maintain the stability of supply, storage reserves, and prices – as up to 30% of businesses are currently endangered by the rapid increase in energy prices.”

Pektas says the same is true for Turkey, which “also has to provide for better gas-supply terms with Iran, Turkmenistan, or Azerbaijan.” He reports that “a gas discovery and exploration project in the Black Sea, if commercialized soon enough, could have a positive impact on Turkish energy prices.”

“The new Bulgarian government also wants to speed up the process for the natural gas interconnector with Greece – the ICGB,” according to Tsekova, “which would bring over natural gas from Azerbaijan and/or LNG from the terminals in Greece. That would give Bulgaria access to alternative suppliers and could potentially lower natural gas prices.”

While Montenegro is not currently importing gas, Vujacic says “connecting to Albania for Azeri gas – with the Azerbaijan pipeline linking to Italy as well – could happen,” to facilitate the eventual phaseout of coal for thermal power plants.

Long-Term Plans

“The war in Ukraine caught us by surprise and, as we say in Bulgaria, ‘put additional oil into the fire’ of the increasing energy prices,” Tsekova says. She reports that the country is considering the construction of two new power units at the existing Kozloduy nuclear power plant, with the project still needing EU Commission approval, and would do well to further explore its hydro and geothermal production potential.

Vujacic says that “work on new solar power plants in Montenegro is expected to start soon, with the government having already picked suitable sites.” The state electric company is also encouraging small-scale household energy production, “under the provision that any extra electricity can be sold back into the grid.” He reports additional hydropower plants of varying sizes are also planned but says the country’s biggest hurdle remains its usage of thermal power plants. “The issue that must be solved, and quickly, if we’re to avoid paying the related EU penalties, is that of the Pljevlja coal-fired power station. It should be closed in 2026 and we’ll need to have another plan in place by then.” Montenegro is not completely disconnected from the EU energy market, Vujacic says. “Some of the reasons behind the price increases – climate protection, for instance – still apply.”

Moldova’s long-term measures, according to Gutu, include “a move to create significant gas reserves; a mandate (and the required resources) for the state-owned energy trading company to explore and develop other gas and electricity sources for imports; an amendment for the diversification of electricity sources, sidestepping (within certain thresholds) the lowest-price requirements; and several country-wide energy efficiency projects – from rural household lighting improvements to urban housing heating systems upgrades.”

Tokaj points out that “the most recent hike in energy prices is a result of global concern about the consequences of the war in Ukraine and, even more significantly, the sanctions imposed or expected on imports from Russia.” He reports that “Polish society appears to be more understanding towards the increase in energy prices resulting from these global implications than from home-made mistakes in developing an efficient energy sector.” He explains that the “programs aimed at addressing growing energy prices are not robust enough,” with the possible construction of Poland’s first-ever nuclear power plant still in preparation. “Another project is related to upgrading existing power lines to high-capacity lines, which is set to cost approximately EUR 7 billion.” In addition, Tokaj says “Poland is about to launch Baltic offshore energy plants. However, all these projects will take at least four or five years to implement.” Citing Poland’s lack of a system for the storage of energy produced from renewable resources, he says it is “difficult to see what actions could be taken immediately,” as concrete steps impacting energy prices.

While also not expecting any significant pricing changes in the short term, Pektas reports that “Turkish renewable installed capacities are increasing, and they will keep doing so, as there are developments underway and plans for more to be built.”

In view of further price increases linked to industry and agriculture, Lichnovsky says the “Czech Republic needs to be reasonable, think long-term, and act quickly, with respect to all energy sources and determination of the energy mix. Stability on the energy market is crucial due to the multiplication effect of energy prices in industry, agriculture, and other sectors.”

“We anticipate the current prices of electricity will trigger a number of photovoltaic projects in the Czech Republic which should, even without any subsidies, lead to sufficient energy production for households and smaller businesses,” Lichnovsky says. However, it’s not only about production: “the efficient distribution of electricity – through the implementation of smart grid and other technology features – is a challenge we are currently facing,” he explains, noting that the country has “a strong position in R&D of technologies for effective distribution.”

(Green) Lessons Learned

“The prices Bulgarian businesses and households pay for energy will increase,” Tsekova concludes, “and the social impact of any further energy price increases could be awfully hard. The government’s idea was to cover – through the moratorium and other measures still in place – the coldest months of the year. In addition, we are yet to face the results of the newly introduced sanctions towards Russia and Russian state-owned companies in the energy sector – no one dares predict where this will lead us in the coming months.”

“With most people being employed in services and those sectors well-positioned for new jobs and further growth, our industry not being as green as it could have been does not seem like much of a problem in Montenegro,” Vujacic says. “Still, I’m a firm believer that we must be part of the European Green Deal – money is still cheap for such projects, foreign investors are willing to support the government on it, and the alternative is unpalatable – we don’t have other kinds of solutions.”

“The Czech Republic has sufficient resources to maintain its independence in electricity production through a proper consideration of the energy mix – construction of stable nuclear sources of electricity, supplemented by gas, coal (both from diversified sources and with decreasing importance), and renewables, especially photovoltaics, given the Czech environmental potential – in course of the implementation of the EU Green Deal and the Fit for 55 targets,” Lichnovsky concludes. “A sufficient and stable energy supply is now the necessary basis for the development of other sectors and the functioning of society as a whole.”

“Forward energy prices were starting to decrease and were expected to drop much lower than they are today. The war in Ukraine has already dampened this trend but I do not expect a complete reversal in the long run,” Pektas says. “So, it’s not impossible to imagine things going back to normal, and then countries like Turkey, and especially their more at-risk citizens, might start doing better,” he concludes.

“Tellingly, Polish society is now reaping the consequences of not having invested adequately enough and early enough in energy transformation,” Tokaj says. “It needs to be done right away, although it will now have to be done under the pressure of growing energy prices. However, Poland appears to be better prepared than many other nations in making a smooth transition from importing Russian fossil fuels to alternatives and safer sources.”

“All these initiatives had been on the back burner for a long while,” Gutu says. “They have now received a push, as they are not just about the environment anymore. So, there is an increased political will and public demand for speeding up the energy efficiency projects, for implementing the interconnectors, and for streamlining renewable electricity generation.” The rest is down to the weather and geopolitics, he says in conclusion, but “rather than try to predict energy price trends, countries should probably do their best to be more prepared. To make both their economies and their legal systems more resilient.”

This Article was originally published in Issue 9.3 of the CEE Legal Matters Magazine. If you would like to receive a hard copy of the magazine, you can subscribe here.