One of the most significant limitations of the national economic capacity is labour shortages, namely the lack of professionals, skilled and experienced workforce. In order to recruit the best qualified candidates, companies shall develop ways to become attracting.

Over recent years, the ability to attract and retain highly qualified employees, has become a competitiveness factor. In the meantime, financial security, housing assistance and appealing working environment may also contribute to retain employees.

The salaries of different industrial sectors in Hungary are significantly different. In some cases, Hungarian average salaries are below the regional average and the Western-European standards. However, in other sectors, the national salaries are in competition with not only the neighbouring countries, but also with Western-European salaries as well.

Are national salaries and tax wedges competitive in a European comparison?

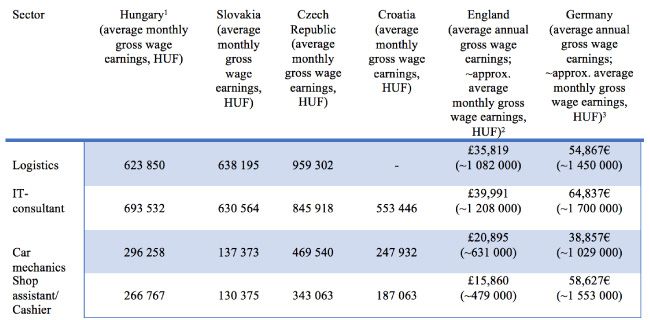

The associates of KCG Partners prepared the below table, that represents four arbitrarily selected industrial sectors in Hungary, in three neighbouring countries (Slovakia, Croatia and the Czech Republic), in England and in Germany. It is clear from the table that the salary of a Hungarian logistics manager or IT consultant is competitive on a regional level, and it is very close to the average salaries in Western- Europe.

On the contrary, salaries of car mechanics employed in the production line or the salaries of shop assistants/ cashiers employed in commerce are far below from the English, German salaries, although it can be noted that they fit into the regional (Central -Eastern European) average.

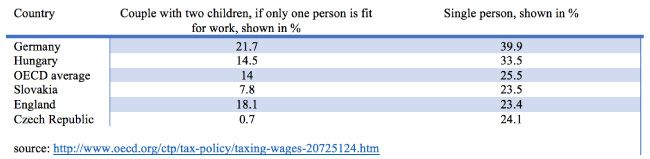

The following table provides details of the percentage of tax wedges in the aforementioned countries (except Croatia), based on the publicly available data, published by the OECD. The figures in the table show the sum of personal income tax and employee social security contributions minus cash benefits as a percentage of gross wage earnings.

The table illustrates that among the assessed countries, the tax wedge in case of a couple with two children, where only one of them is fit for work is the lowest in the Czech Republic and the highest in Germany. High level of tax wedge is also typical in Germany in case of a single person, however we note, that in this category Hungarian tax wedge is also considered high, in comparison with the assessed countries.

According to a survey carried out in 2018, more than half of the surveyed companies conducted an active recruiting process for the vacant positions. In the year of 2018, trade, manufacturing and other production and IT/technology industries were mainly affected with the above-mentioned recruitment process. Employee recommendations are considered by the interviewed companies, as the most effective source to fill a vacant position with the right person.

What measures can be taken in order to increase the retention capacity of an industry, how can a company become more attractive for employees?

One of the most important lessons to be learned from changes shaping the labour market, as mentioned in the introduction, is that the management of labour market’s problems is a joint responsibility of employers, employees and the government. The measures, taken by the Hungarian government were, for example, in one hand the employment protection action that has resulted in savings of HUF 600 billion for companies since 2013 and affected 900,000 employees or on the other hand the decision on the reduction of social contribution tax.

What companies can individually do in addition to the aforementioned government actions to retain employees: promoting labour mobility (a common practice for larger companies is to provide transportation for employees, 70 to 80 kilometres for the factories), providing housing assistance (although, we note that tax exemption of housing assistance for mobility was discontinued as of 1 January 2019, therefore if the employer continues to provide such benefit to the employees, it is taxable benefit), and granting stable, predictable salaries and other benefits.

Experience has shown that Hungarian employees, in addition to wages, value stability and the comfort of the working environment, while seeking employment. Comfort is enhanced by, for example, an ergonomically designed production line, wifi service, or a good working community could also be an important employee retaining force. Experience shows that about 50-60% of physical workers are considered to be stable and loyal to the company in the long term, but 20-30% of them are willing to change their positions even for the difference of thousands of forints.

Additionally, we would like to mention the difficulties concerning the recruitment of executive employees, who can be motivated with entirely different factors than physical workers. In this case, besides the exciting, interesting and challenging tasks, financial benefits and company car can be important factors. In case of office work, flexible work or even remote work options may be appealing for candidates.

By Eszter Kamocsay-Berta, Managing Partner, KCG Partners Law Firm