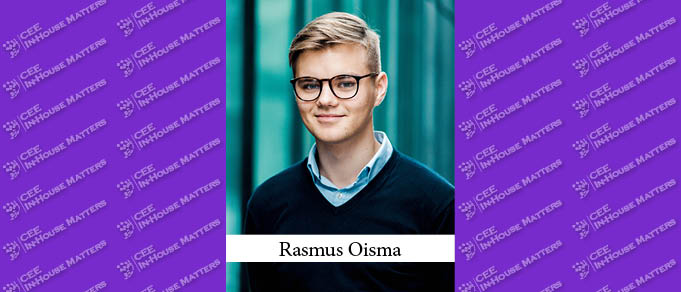

On August 19, 2021, CEE Legal Matters reported that Sorainen had advised Montonio on raising EUR 2.5 million from Tera Ventures, as well as ffVC, Superangel, Practica, 365.fintech, Startup Wise Guys, and a number of business angels. CEE In-House Matters spoke with Rasmus Oisma, Director at Montonio Finance, to learn more about the matter.

CEEIHM: Montonio recently secured a EUR 2.5 million investment. What are the funds intended for this time?

Rasmus: Our next major target is to start providing our services in Poland. We have a strong track record and incredible traction from the Baltic states. Our services are used by more than 1,400 web stores in Estonia, Latvia, and Lithuania. A quarter of our native Estonian population used Montonio’s services within the first half of 2021. Now it’s time to take on even bigger markets.

Furthermore, we intend to be the one-stop-shop for e-commerce stores. Meaning that we want to provide our partner merchants with all the checkout services they might need. Achieving this requires a lot of development resources.

CEEIHM: What, in your opinion, makes Montonio attractive to investors?

Rasmus: I guess every investor has their own reasons, but it seems that they find our long-term vision attractive. The popularity of fintech and specifically BNPL companies has grown greatly during the last few years. Our checkout orchestration model definitely stands out in comparison to our competitors. Of course, our strong traction helps a lot as well.

And also the team – the core team has been working on Montonio for more than three years and we have been able to show remarkable success and traction. We have seen tougher times and the collaboration dynamic has grown into something significant.

CEEIHM: Has the investor lineup changed since the last year’s investment round and why?

Rasmus: The round was led by Tera Ventures with ffVC (US-Poland) and 365.fintech (Slovakia) joining in as new investors. There were other major reputable venture capital firms who were ready to make a commitment. However, we had to say no to quite a few of them.

Most of our previous investors participated in the round – Superangel, Practica Capital, Startup Wiseguys, and Jevgeni Kabanov (CPO of Bolt). There were other previous investors who wanted to pitch in, but we had to make some cuts in the investor lineup since the interest was nearly 3x the size of the round itself.

We had a few new angel investors participating in this round, specifically Markus Villig (the CEO of Bolt), Kair Kasper (co-founder of Klalu, ex-Pipedrive), and Sven Kirsimae (CTO of Rendin, ex-Pipedrive). The angel investors were included in the round for their know-how and connections in the startup world.

CEEIHM: What are Montonio’s next steps, following the investment?

Rasmus: The first step we have taken is growing our team. We expect to double the size of our development team. We are expanding our sales and operations significantly in Latvia and Lithuania. Furthermore, as Lithuania is the center of our compliance operations, we will start hiring additional legal/compliance personnel in Vilnius.

We intend to streamline our internal processes, by automating a lot of activities that currently need human involvement. Our goal is to keep our operational overheads as thin as possible, to be continuously able to provide lean and affordable services to our customers.

CEEIHM: What was Sorainen’s mandate on this deal?

Rasmus: Sorainen was our advisor for the whole process from the first term sheet review until the closing of the round. They helped us out with the contract drafting, legal negotiations, and the financial services regulatory side review in both Estonia and Lithuania. Our main point of contact was Mirell Prosa, with further assistance from Toomas Prangli, Robin Teever, and Vladislav Leiri. Jane Eespold and Liutauras Vasiliauskas helped us with the questions relating to financial services regulations.

Furthermore, Ieva Brimeriene and Asta Javinskaite from Trampoline Legal are assisting us with getting the necessary regulatory approvals from the Bank of Lithuania.