BPV Braun Partners and Domanski Zakrzewski Palinka, working with Watson Farley & Williams, have advised Creditas Group on its acquisition of Duon from Infracapital with financing from Komercni Banka. Dentons advised Duon. White & Case reportedly advised Komercni Banka.

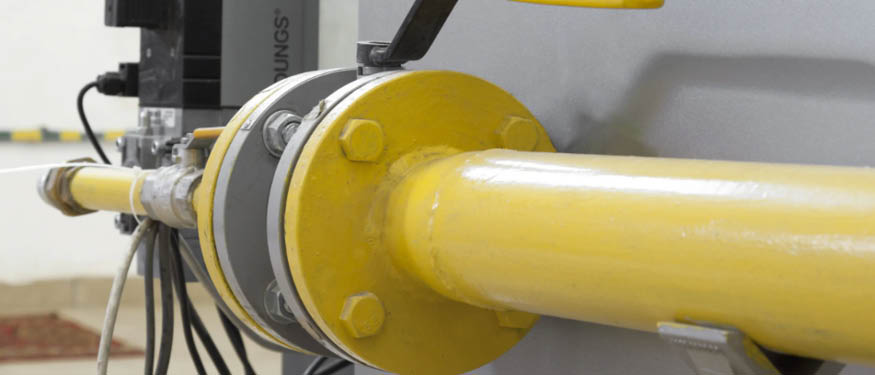

Duon is a private gas distributor in Poland. Its assets include more than 800 kilometers of gas pipelines, 12 networks connected to the national grid, 24 LNG-based cryogenic trailers, and 20 gas regasification stations, serving over 11,000 customers.

Infracapital is the infrastructure equity investment fund of M&G, a UK-based investment house.

The BPV Braun Partners team included Partner David Vosol, Counsels Pavel Vintr and David Plevka, and Associate Ivana Horakova.

The Dentons team included Budapest-based Partners Rob Irving, Pawel Grabowski, and Maciej Skoczynski, Senior Associate Sebastian Ishiguro, and Associates Aliz Wulcz and Brigitta Kovacs as well as Warsaw-based Senior Associate Beata Blaz.

The DZP team included Partners Marcin Krakowiak and Magdalena Skowronska and Senior Associate Tomasz Kalicki.