The COVID-19 epidemic and consequent restrictive measures strongly affected Slovenia’s economy, including the country’s rental market. The COVID-19 epidemic impacted all commercial leases, with tourism, hospitality, and to an extent retail among the sectors suffering most. Commercial properties with strong tenants such as IT & Life Science companies and public sector entities proved to be much more resilient than commercial properties dependent on tenants from distressed sectors.

Life Science M&A Deals on the Rise in Slovenia

Foreign investors of all types were increasingly interested in Life Science (LS) companies even before COVID-19 emerged. It is no wonder that Slovenian LS companies are of particular appeal, since this highly innovative community significantly contributed to Slovenia being ranked 21st in this year’s Bloomberg Innovation Index. Some say COVID-19 catalyzed the new deals this year, but they were more likely fostered by the new investment opportunities that keep popping up with each innovative solution offered by the relatively small (and relatively inexpensive) companies in Slovenia. The race to acquire these innovative scale-ups and start-ups has become increasingly competitive.

The New Foreign Direct Investment Screening Regime Under Austrian and Slovenian Law

After many years of liberalization and globalization, recent years have shown a reversal of the European Union’s approach concerning foreign direct investment from third countries. As in much of the world, the EU has taken a more restrictive view than in the past, and this view is reflected on the legislative level with the FDI Screening Regulation.

Slovenia: Will the COVID-19 State Guarantee Scheme Start Functioning Shortly?

In response to the COVID-19 pandemic, Slovenia swiftly introduced certain measures in the field of banking with the goals of promoting the liquidity of Slovenian businesses and stimulating the banks to support the country’s economic recovery. Such measures included mandatorily available 12-month moratoria on bank loans (further supported by a smaller-sized EUR 200 million state guarantee scheme for the moratoria-affected amounts), and a larger-scale EUR 2 billion state guarantee scheme for certain new bank loans. However, such measures proved less popular that expected.

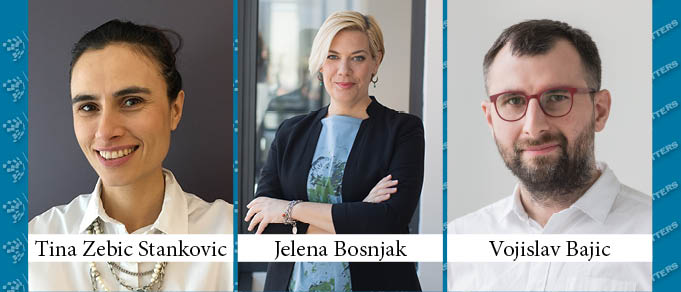

The Corner Office: Most Meaningful Charity or Pro Bono Commitment

In The Corner Office we ask Managing Partners across Central and Eastern Europe about their unique roles and responsibilities. The question this time: “What one ongoing pro bono initiative or project or charity/volunteering project that your firm is involved with has the most meaning for you personally, and why?”

Marketing with One Arm Tied Behind Your Back: Attorney Advertising Bans In the Former Yugoslavia

Advertising is no easy task for law firms in the former Yugoslavia, and law firm marketing and business development specialists in those legal markets face unique challenges in their attempts to promote their firms and obtain new clients.

Slovenia: Could Covid-19 Investment-Enhancing Measures Affect the Autonomy of the Slovenian Competition Regulator?

In addition to the effect of the newly introduced FDI rules, the upcoming post-epidemic period in Slovenia will see extensive efforts to revive the economy. On May 29, 2020, Slovenia’s Parliament adopted the Intervention Act to Remove Obstacles to the Implementation of Significant Investments to Start the Economy After the COVID-19 Epidemic to restart economic activity and growth in key investment sectors.

Guest Editorial: Lessons Learned in the Law – From Ljubljana

It was nineteen years ago, but I remember it vividly as if it were yesterday: fresh out of law faculty and green with excitement, I was sitting in my very first job interview when the question fell: “Do you know anything about mortgages?” I started reciting: “A mortgage is a real right of a third person …,” when my future mentor smiled and exclaimed: “Ah, never mind, you will learn!”

M&A in Slovenia in 2020: Review and Preview

Although, like many other CEE jurisdictions, Slovenia experienced major COVID-19-related market turbulence in the first half of 2020, the market has nonetheless seen some interesting developments as well – and more activity is likely to follow in Q3 and Q4.

Rebuilding and Reshaping in the Aftermath of COVID-19

As Europe begins a tentative re-opening following several difficult months of quarantining, social distancing, and working-from-home, we spoke to CMS’s Warsaw-based Employment Partner Katarzyna Dulewicz and Vienna-based Dispute Resolution Partner Daniela Karollus-Bruner for their perspective on the process.

Slovenia: A Path Towards Efficient Energy Consumption

Efficient energy consumption, reducing CO2 emissions, and energy from renewable sources have been in the spotlight of the European Union for a while now. Although the Republic of Slovenia has not attained the goals envisaged by the EU by 2020 – i.e., a 20% share of energy produced from renewable sources (i.e., 20% increase in energy efficiency and 20% reduction in CO2 emissions) – it remains above the EU average in that regard. Renewable energy sources amount to less than 3% of the overall energy produced in Slovenia, with the rest acquired through nuclear power (40%), fossil fuels (33%), and hydro energy (25%), allowing for substantial growth of the former in the future.

The Big Deal: Interview with CMS’s Eva Talmacsi About OTP/Societe Generale Acquisitions

Over the past few years CMS advised the OTP Bank Group on an extensive series of acquisitions across Bulgaria, Moldova, and former Yugoslavia. This series of separate deals was shortlisted for CEE Legal Matters’ CEE Deal of the Year in each of the countries involved, actually winning the 2018 Deal of the Year for Bulgaria and the 2019 Deal of the Year Award for Montenegro. We reached out to Eva Talmacsi, who led CMS’s multi-jurisdictional team, to learn more about the firm’s impressive work on OTP’s behalf.

Slovenia: Will Regulation Catch Up with the Rapid Growth of the CBD Market?

CBD products are the latest consumer fad, and demand and supply has significantly increased all over the world. The market for CBD products is projected to keep growing, and according to some estimates, the European CBD market should be worth some EUR 1.5 billion by 2023. Despite such rapid development and expansion, placing CBD products on the Slovenian market remains somewhat of a legal grey area.

The Corner Office: 2020 Initiatives

In The Corner Office we ask Managing Partners across Central and Eastern Europe about their unique roles and responsibilities. The question this time around: What major initiative or new plan does your office (or firm) plan – if any – for 2020?

What Makes a Good Conference Great?

Love them or hate them, conferences are a fundamental part of the successful commercial lawyer’s calendar. But time is precious. Those calendars are full. It’s vital for conference organizers to get them right, and critical for lawyers to choose wisely in determining which events to attend and which to skip.

Slovenian Legislature Finally Adopts Act to Protect Expropriated Holders of Banks’ Qualified Liabilities

In December 2013 and (for one bank) in 2014, the Bank of Slovenia – the Slovenian central bank –imposed various extraordinary measures on six Slovenian banks. These measures resulted in a comprehensive bail-in and the termination of not only all the shares in each bank but also all subordinated financial instruments issued by them.

Capital Markets in Slovenia

Contributed by Jadek & Pensa.

CEELM Covid-19 Comparative Legal Guide: Contracts in Slovenia

Contributed by Law firm KBP, member of Adriala