We bring you a brief overview of important legislative news from the Czech Republic that should not escape your attention.

On the limitation of the scope of the statutory pre-emption right under Section 3056 of the Civil Code (CZ)

The legal right of pre-emption of the owner of the building to the land under it does not arise for the entire land on which the building is located, but only for that part of the land that is necessary for the exercise of the ownership right to the building. The division of the land must not significantly complicate the use or enjoyment of the divided land.

Repayment of debt by a third party without the debtor's consent

A third party can repay the debt to the creditor even without the debtor's consent, unless the debtor expressly agrees with the creditor to prohibit the repayment of the debt by a third party (NS File 28 Cdo 1214/2023).

Planned Register of Representatives

The Chamber of Deputies passed an act on so-called central records of digital powers of attorney for negotiations with the state administration. It will be a database of granted representative authorisations, in which the authorities will verify the existence and validity of the relevant power of attorney themselves. There will thus be no need to submit a paper power of attorney. Ideally, the system should be operational from July this year.

Dishonest intent in debt relief (trust fund)

A debtor who, in a relatively short period of time before filing an insolvency petition in conjunction with a request for debt relief, handled its real estate in such a way that it was not subject to enforcement by the creditor (by putting it in a trust fund), is not acting honestly, and there is reason to "assume" on this basis that the debtor is pursuing a dishonest intention by submitting a debt relief application.

News in AML legislation

On 6 March 2024, the Senate approved yet another amendment to the AML Act. In addition to increasing the upper limits of some fines and expanding the range of obliged persons, it also establishes the possibility for obliged persons not to screen the client if this could frustrate or endanger the investigation of a suspicious transaction (so-called "tipping-off" or warning). In such a case, the obliged person must immediately report the suspicious transaction to the Financial Analytical Office.

Senate approves a bill on non-performing loan market law in early March

The new law transposes the EU directive and is supposed to strengthen the crisis resistance of the European Banking Union. According to the law, a non-performing loan is a loan, credit or similar financial service (e.g. operational leasing) provided by a bank or other similar credit institution, if (i) the borrower is unlikely to repay its obligations in full or (ii) any of the obligations is more than 90 days past due. Newly, only persons from a legally defined circle and based on the permission of the Czech National Bank will be able to manage the non-performing loans defined above. In addition, the law lays down the rules on how each administrator of non-performing loans must be managed and governed. The market for receivables from non-performing loans and the rules for dealing with debtors will also be regulated.

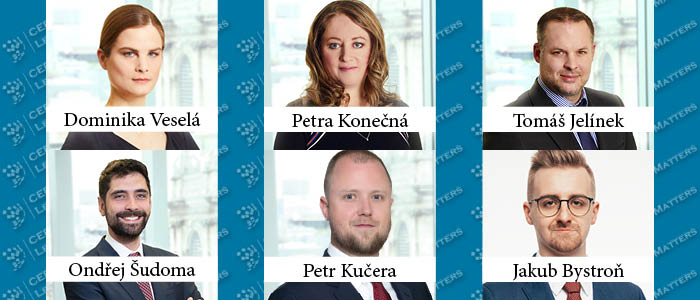

By Dominika Vesela and Petra Konecna, Partners, Tomas Jelínek, Senior Associate, Ondrej Sudoma and Petr Kucera, Associates, and Jakub Bystron, Trainee, Eversheds Sutherland