Zepos & Yannopoulos has advised Greenvolt on its acquisition of a 200-megawatt solar project in Farsala, Greece, from the Archirodon Group.

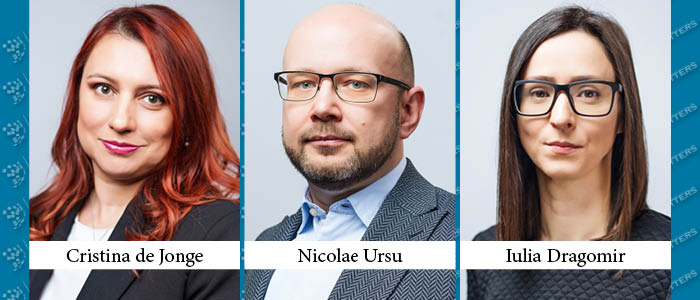

Cristina de Jonge, Nicolae Ursu, and Iulia Dragomir Make Partner at BPV Grigorescu Stefanica

Former Managing Associates Cristina de Jonge, Nicolae Ursu, and Iulia Dragomir have been promoted to Equity Partners at BPV Grigorescu Stefanica.

Pre-Emption Right for the Hungarian State in Case of Solar Power Investments

As of 13 January 2024, a new government decree amends the provisions of the clearance procedure of the Government Decree on certain foreign direct investments (“FDI”). The amendment grants the Hungarian State a right of first refusal in respect of acquisitions of strategic companies whose main or additional registered activity is electricity production and pursue solar power plant-related activity that are to be acquired by foreign investors.

New Measures to Reduce Mutual Debts on the Electricity Market

On 8 January 2024, the Ministry of Energy of Ukraine issued the order "On Measures to Reduce Mutual Debts on the Electricity Market" (the "Order"), which sets out the methods for dealing with the situations where market participants have unpaid bills to each other. The purpose of the Order is to stabilize the operation of the electricity market and reduce debts in its specific segments.

Dentons and Norton Rose Fulbright Advise on PCP Financing for Susi 167-Megawatt Renewables Portfolio in Poland

Dentons has advised P Capital Partners on a euro-denominated senior debt package to project companies controlled by Susi Partners, acting on behalf of the Susi Energy Transition Fund, for a 167-megawatt portfolio of photovoltaic and wind power projects in Poland. Norton Rose Fulbright advised Susi.

Jacek Blachut, Jacek Budzik, and Bartlomiej Jarco Make Partner at SPCG

Former Attorney at Law Jacek Blachut and former Counsels Jacek Budzik and Bartlomiej Jarco have been promoted to Partner positions with SPCG in Krakow.

DLA Piper Advises OX2 on Construction of Wind Farms in Poland

DLA Piper has advised OX2 on the construction of the Juniewicze, Grajewo, and Sulmierzyce wind farms with a total capacity of over 100 megawatts.