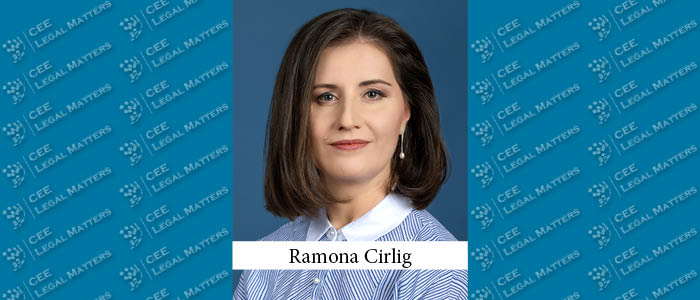

Primarily driven by greenfield investments, supply chain overhauls, and geopolitical implications, the hottest practice of Noerr’s Warsaw office has been Real Estate, according to Associated Partner and recently appointed Head of Office Pawel Zelich.

“Our Real Estate practice has been one of the hottest, if not the hottest department of our office for a while now,” Zelich begins. Driven by the overall state of affairs in Poland, the Real Estate practice of Noerr spills onto other departments as well. “The ebb and flow of our Real Estate practice are inextricably linked to our other departments, meaning that it is also a good representative of our overall workload and activities.”

Zelich continues by explaining that the post-COVID-19 realities have incentivized investors in many industries to primarily re-evaluate their supply chains. “The general way of thinking, pre-COVID-19, was that supply chains were quite solid, but it was proven that this was not much the case as the pandemic progressed,” he says. “Now, as we’re in a re-shape phase, many investors are seeking to overhaul their supply chain lines in order to make them more resilient and less thinly stretched.”

Additionally, Zelich reports that Noerr has also been active in numerous cross-border projects and transactions. “We have been doing work that engages a number of investor portfolios in various sectors – logistics, industrial, production – the bulk of our engagement is, usually, due diligence reviews, buy/sale, leases, and direct construction-related transactional tasks,” he explains. “We have also been rather active in dealing with matters related to state aid – it is quite important for all greenfield investments, and greenfield investments have also been one of the key drivers of work for us,” Zelich points out. In his opinion, state aid plays such a big part in these investments as “the competition between countries – when it comes to attracting investors – is cut-throat, and providing state aid or not doing so might mean the difference between attracting an investor or losing out.”

Furthermore, Zelich says there was a marked uptick in work as a consequence of the war in Ukraine. “Poland has been placed in a position of being perceived as a ‘front-country,’ for better or worse. Still, in a number of sectors this hasn’t thrown off investors by a lot – it was mostly the case of reconfiguring certain investments,” he explains.

Finally, considering the current key drivers of work, Zelich says that “while it is difficult to predict how the real estate landscape will look like in the next six months, I am optimistic. There are a number of factors impacting several different sectors in different ways – for example, the hike of financing costs impacts residential adversely, but this has not seemed to stifle manufacturing greenfield projects coming over to Poland,” he explains. “Still, based on current activity levels and our overall experience, I am hopeful that there will be a substantial increase in our workload,” he says, looking to the future.