The China Central and Eastern Europe Investment Co-Operation Fund, established by the China Export Import Bank in partnership with the Hungarian Export Import Bank and other institutional advisors from CEE, is off and running. And Judith Gliniecki, General Counsel at CEE Equity Partners Ltd., investment advisor for the Fund, is getting rave reviews for her work on its behalf. With Gliniecki’s help, the most significant source of Chinese investment in CEE is finding smooth sailing.

The Right Call

Born in the American Midwest and educated at Harvard, American lawyer Judith Gliniecki had long hoped to work in what she called “the new exciting world” that followed the fall of the Iron Curtain. Pursuing that goal, in 1994, after a few years in private practice in Ohio, Gliniecki joined Hunton & Williams in Warsaw. She has been in Warsaw ever since, first with eight years at Hunton & Williams, then another five as partner at a pair of Polish firms, before moving over to Wierzbowski Eversheds, where she was Head of the firm’s Corporate/M&A practice for almost 7 years.

One day in May, 2014, Gliniecki – who, despite her impressive Polish career still refers to herself modestly as “just an Ohio lawyer” – received a phone call out of the blue from Dario Cipriani, one of CEE Equity’s Investment Directors, who said to her, simply, “we’re thinking about doing something new, and we’d like to talk to you.”

Gliniecki recalls that “it was so interesting, what they were doing, and I had been at a point in my life where I was interested in change. At that point I was actually thinking about wanting to transition back to the United States at some point, probably in an in-house role, so the idea of taking on a GC role here in Warsaw, doing transactions – which I love to do, and which certainly plays on my strengths – was an irresistible temptation, so I didn’t hesitate long.”

She accepted the challenge and moved to CEE Equity.

A Remarkable First Year

Well, maybe a little bit more than zero.

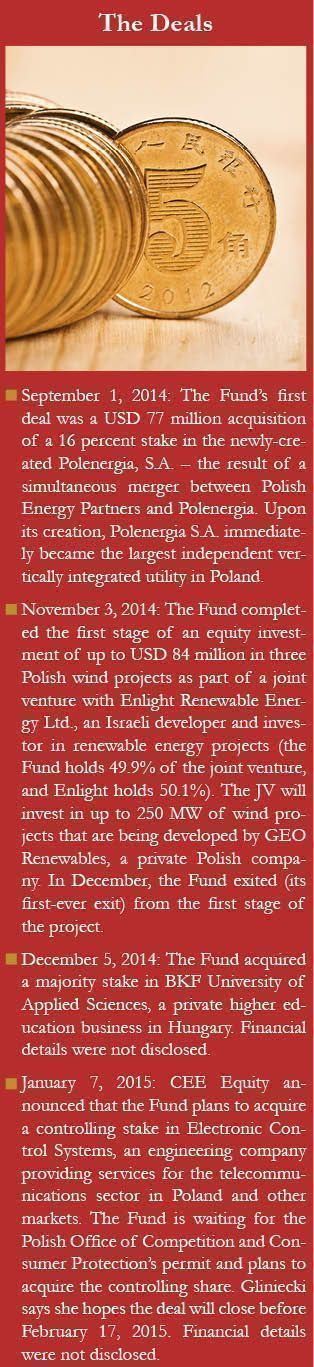

The Fund – initially seeded with USD 500 million – was established in the beginning of 2014 to capitalize on investment opportunities in Central and Eastern Europe. It focuses particularly on four sectors: Infrastructure, Energy, Telecommunications, and Specialized Production.

The Fund focused on Polish investments in its first year, but Gliniecki insists that “the China-CEE Fund has a mandate to invest in 16 Central and Eastern European countries” (the Fund’s definition of “CEE” does not include Austria, Russia, Ukraine, Belarus, Greece, Turkey, and Kosovo), “and our goal is to invest in each of these countries.” As evidence she points to the Fund’s most recent acquisition in a country that happens to be home to the Fund’s second largest sponsor – the Hungarian Exim Bank: “the transaction we did with BKF, that was part of our strategy of looking very seriously at Hungary, given who one of our investors.”

Although the Fund’s primary sponsor is Chinese – Gliniecki concedes that the China Exim Bank contributes “more than the lion’s share” of the Fund’s capital – there is no sign of deeper political or cultural motives in its creation. Gliniecki, for instance, insists that when CEE Equity evaluates a potential investment, “there is no requirement that it has to be politically correct or have a Chinese angle.” And there are no Chinese nationals working with CEE Equity. Instead, Gliniecki says that the company is made up of “Brits, Americans, a bunch of Poles, Octavian Vidu in Romania, [and] Tamas Szalai in Hungary.” She explains that, “the whole idea was to have a multi-national group … because we’re the investment advisor, the idea was to provide that bridge between local people sourcing deals.”

The Fund’s sponsors await at the other end of that bridge, and Gliniecki makes sure they’re fully informed and involved. She says, “I do all the backend work to make sure that all of our sponsors – particularly China Exim – understand the deal, are comfortable with the deal, feel comfortable with the legal parameters, and I think that’s one of the keys of our success, is that our group makes that happen – makes sure that all the parties are on the same page when you’re looking at the transaction.”

The Lawyer Guiding Lawyers

Both Gliniecki and the external counsel she instructs on behalf of CEE Equity point to her background as a significant strength. Gliniecki says, “as I was in private practice until joining CEE Equity, I think that I am well-placed to work with our external counsel to deliver legal services that my business team needs.” Maciej Zalewski at White & Case, who advised CEE Equity on the Fund’s exit from the first stage of the GEO Renewables/Enlight deal, makes the same point: “Judith has the background of working as a lawyer and a partner with a global law firm … so with this experience she knows exactly what is needed, and she knows how demanding the transaction might be. She is demanding, that’s true, but this is justified from her experience from working on these transactions, and she is perfectly aware where the potential threats might be.”

Both Gliniecki and the external counsel she instructs on behalf of CEE Equity point to her background as a significant strength. Gliniecki says, “as I was in private practice until joining CEE Equity, I think that I am well-placed to work with our external counsel to deliver legal services that my business team needs.” Maciej Zalewski at White & Case, who advised CEE Equity on the Fund’s exit from the first stage of the GEO Renewables/Enlight deal, makes the same point: “Judith has the background of working as a lawyer and a partner with a global law firm … so with this experience she knows exactly what is needed, and she knows how demanding the transaction might be. She is demanding, that’s true, but this is justified from her experience from working on these transactions, and she is perfectly aware where the potential threats might be.”

Gliniecki’s professionalism draws compliments as well. Zalewski points out: “She also works on transactions with the lawyers. From the very beginning to the end of the transaction. So if we have to work overnight before the closing, she is there.” Zalewski also says that Gliniecki’s attention to detail doesn’t end at closing. He reports that CEE Equity “has a wrap-up session with you after the completion of the transaction, and they brief you on what they liked, and on what they did not like. I really appreciate this feedback, which allows us to build a closer relationship and make our cooperation with the client more effective the next time.” (He laughs: ““We were fortunate enough to get a positive review”).

Gliniecki says that the Fund has “a very strict budgeting process,” which means it operates with external counsel almost exclusively on a fixed fee or capped fee basis. As a result, Gliniecki says, wryly, “I’ve had to have many ‘heart-to-heart’ conversations with some of the law firms that have sort of assumed that the work gets done and we’ll settle up at the end, and I just don’t have that kind of flexibility.” She elaborates: “It does mean that upfront I’ve had to do a lot of work with the firms to make sure it’s been scoped correctly, we have the right elements being taken care of on the legal side, so that there aren’t surprises at the end on the legal end, because I simply don’t have any more budget if there’s a surprise at the end.”

As a result, Gliniecki is committed to ensuring that external lawyers are used efficiently, by not wasting their efforts or time on things she herself is in a better position to handle. “I try to take care of internal matters myself,” she says. “There is no sense in paying external lawyers to help us get our ducks in a row, to get internal approvals or to provide corporate documents or other Fund deliverables.”

Thus, for instance, referring to the request for approval from the Polish Competition Authority relating to the Fund’s acquisition of a controlling stake in ECS, Gliniecki recalls, “because China Exim has the lion’s share of the Fund, I ultimately had to get information about China Exim with respect to the filing.”

Dorothy Hansberry-Biegunska, the Competition expert who Gliniecki instructed on the matter, was highly impressed by Gliniecki’s dedication to fulfilling her own obligations. “In terms of them getting approval and the directions, I have to say, it was absolutely cut and dry, and according to our time line, everything we needed, Judi got. There was a plan, and it needed to be executed, and everything we needed, we got before the internal deadlines.” (For her part, Gliniecki says “I’ve known Dorothy for a long time and brought her in to do our first filing, as I wanted it done right”).

Edward Keller, who led the White & Case team advising CEE Equity on its December acquisition of a stake in the BKF University of Applied Sciences in Hungary (which he describes as “the first sizable private equity investment in a higher education institution in the region”), doesn’t mince words when expressing his respect for the Fund and its representatives. “I hope CEE Equity is a sign of things to come,” he says, “because if you look at how they started this fund, and the incredible professionals that they’ve hired … on the last transaction I worked with Judi and with the Hungarian person on the ground [Investment Director] Tamas Szalai, [who] is one of the top investment professionals I’ve ever worked with, and that they’ve managed to attract a person of his caliber, and also Judi, who was a partner at an international law firm, well-known in the industry, and to be able to attract her in-house, I think is an enormous success on their part. They really picked the right people.”

The Future Is Bright

The Fund’s successful first year has not gone unnoticed by its sponsors. On December 19, 2014, Li Ruogu, the China Exim Bank’s Chairman and President, announced that the bank would be allocating an additional USD 1 billion to investment in CEE. Gliniecki admits that she and her colleagues are excited about the news, but cautions that “it’s a very early stage, you know, [and] final decisions haven’t been made yet.” She won’t deny, however, that “we’re excited to hear that even the Chinese premier has taken note of our little efforts here.”

So times are good. Already in 2015, Gliniecki says, “we have a number of deals that are hot.” And Polish lawyer Magdalena Tyszkiewicz has just joined the team as well, which Gliniecki expects will help her stay on top of everything going on. She’ll need that help, she says with a smile: “Particularly if we get the one billion coming through, for the next few years I anticipate I’m going to be running around like crazy trying to close out the transactions the guys are bringing in the door.”

This Article was originally published in Issue 2.1. of the CEE Legal Matters Magazine.