CMS has advised 6 Degrees Capital and other investors on the EUR 5 million funding round for Nobilegroup. KPMG Law advised Nobilegroup.

CMS Advises Solar Park Trakia on Licensing and Financing of Sinotovo PV Project

CMS has advised Solar Park Trakia on the licensing of the 50-megawatt Sinotovo photovoltaic project by the Bulgarian Energy and Water Regulatory Commission as well as on its financing from Postbank.

King & Spalding, Clifford Chance, and Gecic Law Advise on Telekom Srbija's USD 900 Million Senior Notes Offering

King & Spalding has advised the syndicate of joint lead managers on Telekom Srbija Beograd’s USD 900 million senior notes offering. Gecic Law, working with Clifford Chance, advised Telekom Srbija.

CMS Advises The Boeing Company on Offset Agreement with Poland's Ministry of National Defence

CMS has advised The Boeing Company on an offset agreement with the Ministry of National Defence of Poland.

CMS and Hogan Lovells Advise on Werfen's Acquisition of Omixon Biocomputing

CMS has advised Werfen on its approximately USD 25 million acquisition of Omixon Biocomputing. Hogan Lovells advised Omixon.

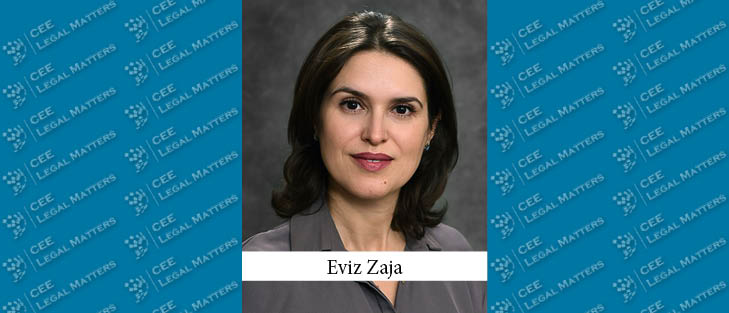

Albania Gets Competitive: A Buzz Interview with Eviz Zaja of CMS

CMS Partner Evis Zaja reports rapid legal and economic developments in Albania, including upcoming amendments in the competition sector, new cybersecurity laws, and the country's increasing appeal to international businesses.

CMS and Schneeweiss Weixelbaum Advise on the Sale of Paso Solutions to Dataciders

CMS has advised the owners of Austrian data and AI service provider Paso Solutions on its sale to Dataciders. Schneeweiss Weixelbaum advised the buyer.

CMS Advises UGT Renewables on Partnership with EPS

CMS, working with Norton Rose Fulbright, has advised UGT Renewables on a partnership agreement with Serbia's state-owned power utility Elektroprivreda Srbije and the Ministry of Mining and Energy for the development and construction of new solar power plants and battery storage facilities in Serbia. Akin Gump reportedly advised the Government of the Republic of Serbia.

Schoenherr and CMS Advise on Fynk's EUR 3.1 Million Seed Financing Round

Schoenherr has advised Fynk on its recent approximately EUR 3.1 million seed financing round led by 3VC with the participation of 10x Founders. CMS advised 3VC.

CMS Advises EBRD on Arvand Bank Financing

CMS has advised the European Bank for Reconstruction and Development on a USD 15 million financing package to Bank Arvand of Tajikistan.

Linklaters and CMS Advise on NEPI Rockcastle's Acquisition of Magnolia Park Shopping Center from Union Investment

Linklaters has advised NEPI Rockcastle on the acquisition of the Magnolia Park shopping center from Union Investment for EUR 373 million. CMS advised Union.

The Corner Office: Legal Tech (to the Rescue)

In The Corner Office, we ask Managing Partners at law firms across Central and Eastern Europe about their backgrounds, strategies, and responsibilities. With industry-specific software emerging left and right, the legal industry was not left behind. To explore some of the trends in this regard, we asked: What are some of the specific legal tech platforms you use?

North Macedonia: Understanding the Evolving Pharmaceutical Legal Landscape and Proposed Reforms

North Macedonia, as a European Union country candidate, progresses toward integrating with the European Union’s regulatory and economic systems. As these frameworks grow more complicated, the country is tasked with continuously aligning its local industry with European and global standards.

The Debrief: October, 2024

In The Debrief, our Practice Leaders across CEE share updates on recent and upcoming legislation, consider the impact of recent court decisions, showcase landmark projects, and keep our readers apprised of the latest developments impacting their respective practice areas.

GIde, Ellex, and CMS Advise on EUR 300 Million Financing for Sunly

GIde and Ellex, working with Ashurst, have advised Rivage Investment, Copenhagen Infrastructure Partners, and Norway's Kommunal Landspensjonskasse on a EUR 300 million IPP financing for the construction of 1.3-gigawatt of solar PV, wind, storage, and hybrid parks in the Baltics and Poland, provided to Sunly. CMS and reportedly White & Case and Sorainen advised Sunly.

CMS and Freshfields Advise on AVL's Sale of Piezocryst to Spectris

CMS has advised AVL List on the sale of its subsidiary Piezocryst to Spectris. Freshfields Bruckhaus Deringer advised the buyer.

Clyde & Co and CMS Advise on Financing for Panattoni Park Bierun I Investment Project

Clyde & Co has advised Panattoni on financing for the Panattoni Park Bierun I investment project from Alior Bank. CMS advised the bank.

CMS Advises Erste Asset Management on Acquisition of Impact Asset Management

CMS has advised Erste Asset Management on its acquisition of Impact Asset Management. Schoenherr reportedly advised the sellers.