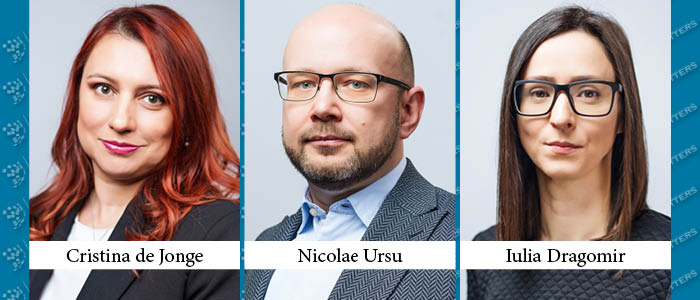

Former Managing Associates Cristina de Jonge, Nicolae Ursu, and Iulia Dragomir have been promoted to Equity Partners at BPV Grigorescu Stefanica.

E-VAT System Goes Online in Hungary

The digitalisation of the Hungarian tax system has reached another important milestone: after lengthy preparatory work (and a few setbacks), the e-VAT system was launched on 1 January 2024, on a voluntary basis, for now.

Recent Amendments to the IT Parks Law Set the Course for Moldova as a Hotspot for BPO

On 21 December 2023 the Moldovan Parliament adopted significant amendments to the Law No.77/2016 on Information Technology Parks („IT Parks Law”) positioning Moldova as an attractive destination for Business Process Outsourcing (BPO). These amendments notably extend the eligibility criteria for IT Park residents, offering particular advantages to export-oriented BPO service providers.

Andriy Fortunenko, Andriy Romanchuk, and Anton Zaderyholova Make Partner at Avellum

Avellum has announced the appointment of Andriy Fortunenko, Andriy Romanchuk, and Anton Zaderyholova as Partners, starting January 1, 2024.

Lithuania: Proposed Tax Changes Bring Uncertainty Among Taxpayers

Lithuania’s tax system underwent a major overhaul in 2004 when the country joined the European Union. For almost two decades, its evolution has been slow-paced – one could even call it cosmetic.

North Macedonia: The 2022 Draft Tax Reforms

Here, we will look at the draft tax reforms proposed by the Government of the Republic of North Macedonia in 2022 (Tax Reforms) that aims to ensure a fair, efficient, transparent, and modern tax system.

Austria: The Start-Up Promotion Act (Start-Up-Foerderungsgesetz)

At the end of May 2023, the Austrian Ministry of Finance issued a new draft law. The Start-Up Promotion Act is intended to create a new regulation for start-up employee shareholdings that should apply to shares surrendered on or after January 1, 2024.